The rise of private equity in the grants management software and corporate social responsibility software markets: What grantmakers need to know

Private Equity (PE) is the elephant in the room

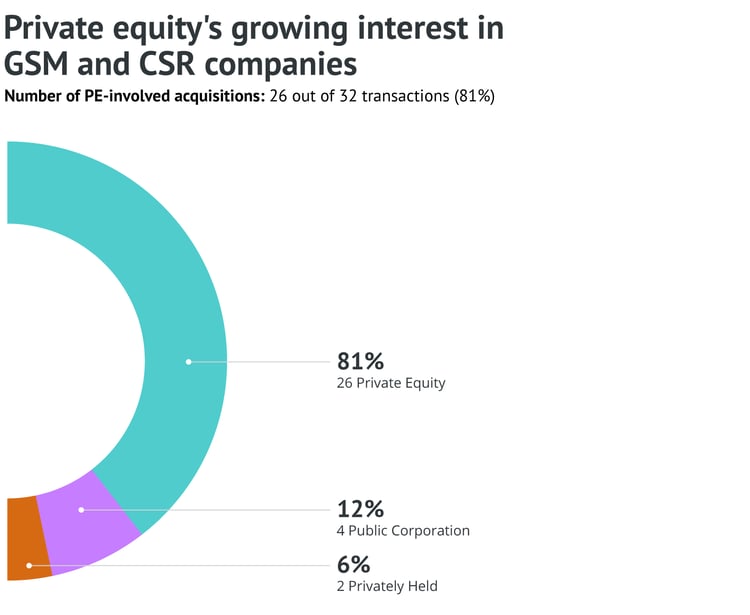

Over the past decade, private equity (PE) involvement in the grants management software (GMS) and corporate social responsibility (CSR) software markets has increased significantly. With the first PE deal occurring in 2010, and eight PE deals between 2014-2018, there have been an incredible 17 deals since 2019. Our previous article, equipped with an illustrative infographic, outlined this growing pace of acquisitions.

How are these acquisitions affecting you? And is this activity good for grantmakers? This article aims to provide grantmakers in the GMS and CSR markets with an understanding of private equity's role in these markets, its potential impact, and the considerations for grantmakers in navigating this changing landscape.

Let’s get started.

Understanding private equity

Private Equity (PE) is an alternative investment class that involves investing directly in private companies or buying out public companies to make them private. The roots of private equity can be traced back to the 19th century when wealthy families, such as the Vanderbilts and the Rockefellers, made direct investments in privately held businesses. However, the modern private equity industry emerged in the mid-20th century.

As of 2021, the global private equity industry had over $4 trillion in assets under management (AUM). The industry has grown rapidly in recent decades, fueled by increasing allocations from institutional investors seeking different sources of returns. At present, there are more than 7,000 private equity firms worldwide.

PE investments can take various forms, including leveraged buyouts (LBOs), venture capital, growth equity, and distressed investments. Each of these investment types serves a distinct purpose in the private equity ecosystem. LBOs, for instance, involve acquiring a company using a significant amount of borrowed money, while venture capital is funding given to startups with high growth potential. Growth equity refers to investments in more mature companies that are looking to scale up, whereas distressed investments involve investing in companies facing financial struggles.

Potential negative consequences for acquired software vendors

Before delving into the specifics, it's essential to understand that PE investments can have profound implications for the acquired companies, particularly for software vendors in the GMS and CSR markets. The impact of these investments can range from changes in strategic direction to restructuring the business model. The following points highlight some potential adverse consequences.

First, there is a potential for a shift in the acquired company's focus towards shorter-term goals rather than longer-term research and development (R&D) efforts. This can result in a lack of investment in product innovation and improvement, which can harm the company's competitive position and customer satisfaction in the long run.

Next, there is often increased risk and uncertainty around the acquired company's future and viability under new ownership. PE firms may have different investment strategies and goals, and may decide to sell or spin off the acquired company at some point in the future. This can lead to uncertainty for grantmakers who rely on the acquired company's software or services, particularly if the company undergoes significant changes or restructuring.

Misalignment of priorities

Private Equity (PE) investors and philanthropy practitioners have different objectives when it comes to outcomes, with PE investors prioritizing financial returns and philanthropy practitioners prioritizing social impact. It is easy to see that the primary goals of grantmakers and PE firms are not inherently aligned, as both have different core objectives and motivations.

The increasing presence of private equity in the GMS and CSR markets has brought new dynamics and potential challenges for grantmakers. While there can be situations where the goals of grantmakers and PE firms converge, grantmakers should be aware of the potential risks and impacts associated with PE involvement in the software vendors they work with. By understanding the nature of private equity, its historical roots, and its potential consequences, grantmakers can make informed decisions and navigate this changing landscape more effectively.

Looking ahead

The intricate world of Private Equity is vast and complex, with numerous strategies and mechanisms at play. As we have seen, it can have profound implications for the businesses it acquires, particularly in the GMS and CSR markets. But our exploration doesn't stop here. In our next article, we will delve deeper into the lifecycle of a PE acquisition and the strategies involved.

Particularly, we will take a closer look at potentially dangerous strategies like Leveraged Buyouts (LBOs). Despite their popularity in the PE landscape, LBOs can pose significant risks to acquired companies due to their heavy reliance on borrowed funds. This method could potentially lead to financial instability or even bankruptcy if not managed correctly.

Grantmakers in the GMS and CSR markets should be proactive in understanding the role of private equity and its potential impact on their work. By recognizing the potential risks and benefits of PE involvement, and considering the vast diversity of private equity firms and their strategies, grantmakers can make informed decisions when considering vendors who best align with their priorities.